We use only legal, ethical, and compliant strategies for asset protection, grounded in established laws developed over the past 50 years. Asset protection is focused on safeguarding your wealth after taxes. This method is not about tax avoidance. Once your accountant maximizes your tax benefits, Cook Island asset protection ensures your assets are completely shielded and protected.

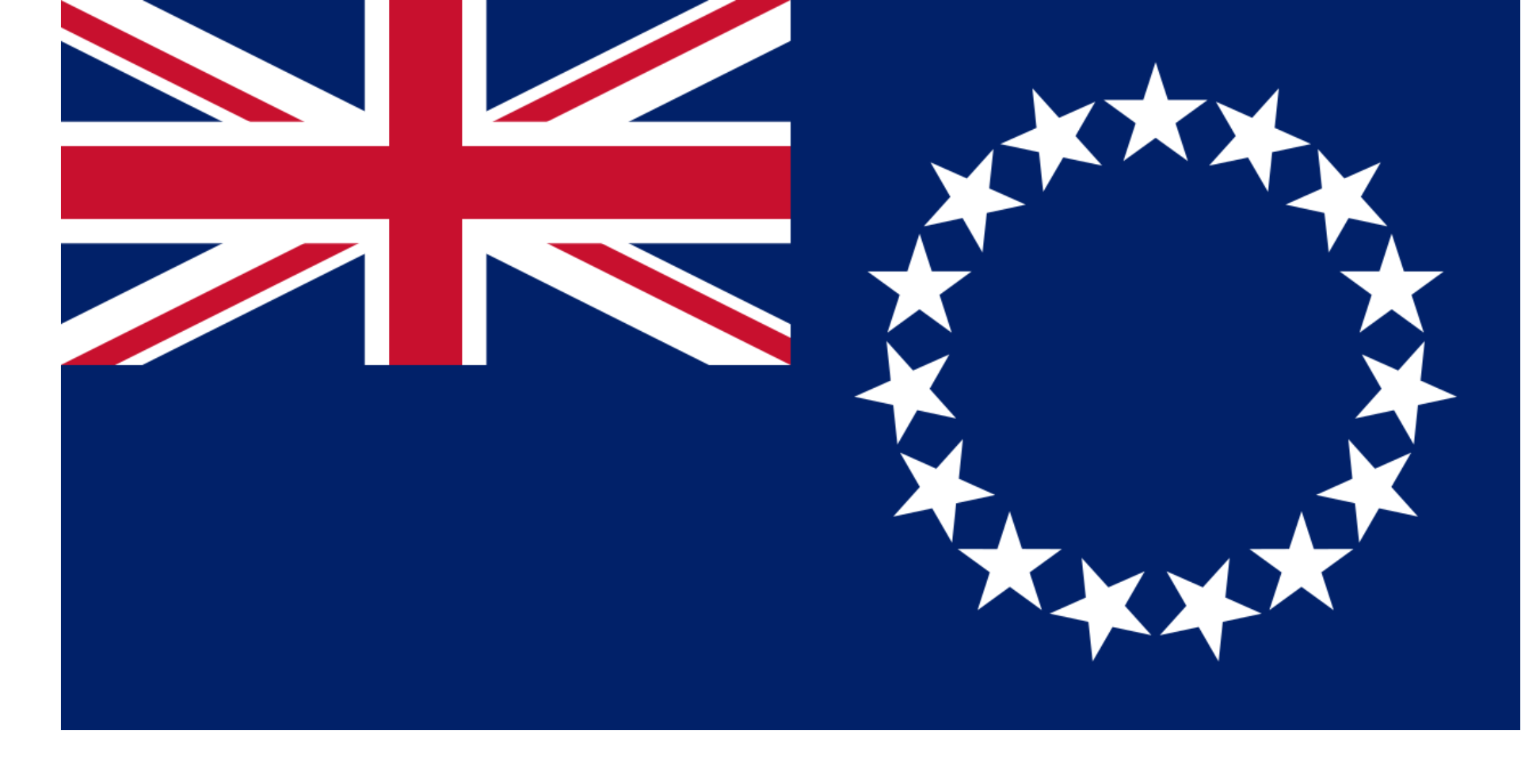

We partner with a highly respected team of professionals regulated by bodies like The Cook Islands Financial Supervisory Commission (FSC), which oversees trustees and ensures the safety of your assets. The Cook Islands, a part of New Zealand, is ranked among the world’s most trusted financial jurisdictions and has over 50 years of experience in asset protection.

Trustees, your designated director for your assets, supported by trust protectors (trusted individuals you choose), manage your assets according to your wishes outlined in your trust document that controls what your trustee must do to carry out your wishes regarding your assets. The FSC monitors these trustees, much like U.S. regulatory bodies monitor wealth managers. With their expertise, the trustee teams we work with offer legally compliant and ethical asset protection solutions, ensuring your wealth is safe from legal threats.

Under New Zealand and Cook Islands law, your trust is completely protected from legal challenges. As a U.S. citizen, you have the right to place your assets in any trust globally, and the Cook Islands offers unparalleled protection for your wealth.